Finnick.

We take care of your ‘license to operate’, so that you can continue your business.

![]()

With a lot of

experience

and a

hands-on

approach,

Finnick offers

you concrete

solutions.

Finnick provides FinTech companies with their ‘license to operate’, so that they can continue doing business. Finnick does this with a practical and entrepreneurial approach and thinks in terms of solutions, so that customers feel supported in their business operations.

Finnick distinguishes itself from other law firms by always being prepared to go the extra mile, its perseverance and ability to make difficult things simple. As a Fintech company you get ‘value for money’ and you always know where you stand.

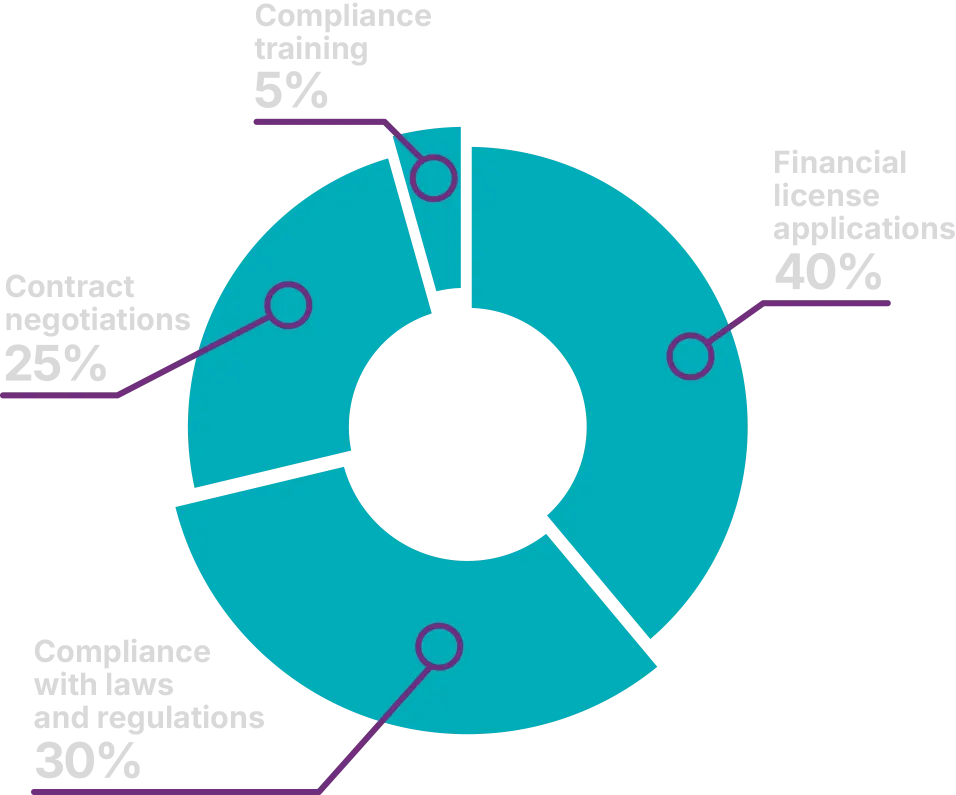

Fintech legal services

Financial

license

applications

A fast, transparent and predictable process

Payments, investments, crypto, crowdfunding, credit providers, intermediaries

Compliance

with laws

and regulations

Stay in control of regulatory compliance

Product development, innovation, customer documentation, policies, supervisors

Contract

negotiations

Clear, balanced and workable contracts – with a focus on what really matters

IT & outsourcing agreements, customer documentation, partnership and white label agreements, credit documentation

Compliance

training

Practical, relevant and

directly applicable

PSD 2 and PSD3/PSR, AML/CFT and AMLR, DORA,

MiFID II, CCD2, FinTech legislation

Our Areas of Expertise

Payments

Payments made simple ánd fully prepared for PSD3 and PSR

Payment licensing, setting up payment propositions, issuing (cards and wallets), acquiring (payment services to merchants), embedded payments, ‘Buy now, pay later’ (BNPL), Open Banking

Investments

MiFID II made simple with clear documentation and strong processes.

Asset management, investment advice and robo-advice, trading platforms and brokers, crowdfunding, tokenised assets, embedded investments.

Consumer & business credit

Keep your financing proposition under control

Consumer credit, business loans, BNPL, credit mediation, crowdfunding and embedded finance

Crypto and blockchain

From MiCA license to supervision-ready processes

MiCA license applications, CASP services, tokenization, NFT, DeFi, Web 3, crypto-asset whitepapers.

A few numbers.

About what Finnick does and what Finnick advises on

Finnick helps FinTech companies with all legal aspects of their business, including license applications (PSD2, MiFID II, CCD2, MiCAR), compliance with financial laws and regulations, contract negotiations, compliance training and the design of financial products and services in the areas of payments, investments, consumer & business credit and crypto & blockchain.

Good cooperation is achieved with the right partners.

Problems are solved together. That is why Finnick believes in a multidisciplinary approach focusing on achieving the goal together. This means not only a thorough legal analysis, but also actively thinking about the implementation of the advice within the company.

Whether you want to work with Finnick or refer a customer to Finnick, Finnick as a partner will do whatever it takes to achieve the desired result. If necessary, other departments or external professionals are also involved. And if you refer your customer to Finnick, your customer always knows where he stands, also financially.